Required Reading for Residential Real Estate Rental Investors

Regardless of whether you plan to go on a nice vacation or spend some time relaxing at home, the holidays can provide some downtime to catch your breath and plan ahead for the upcoming year. After the hustle and bustle has ended, it can also be a great opportunity to...

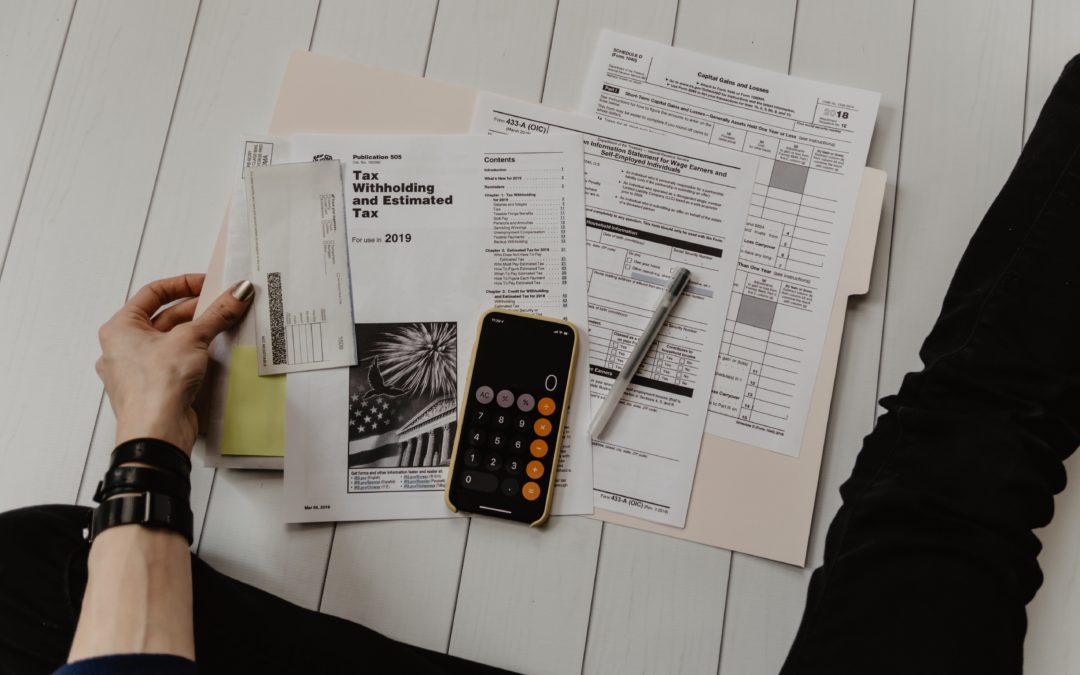

Tax Laws and Rental Property Owners

Owning and managing rental real estate can be a lot of work. It can also require many out-of-pocket expenses, such as a monthly mortgage, maintenance costs, and property management fees. But even so, the regular income – plus a number of favorable tax advantages...

How Taxes are Determined on the Sale of Investment Property

If you own investment property and the time has come to sell it, then the taxes on that sale could make a big difference in the amount of money that you are able to net from the deal. And this, in turn, can have an impact on any subsequent purchase, payoff of debt, or...